Who we are

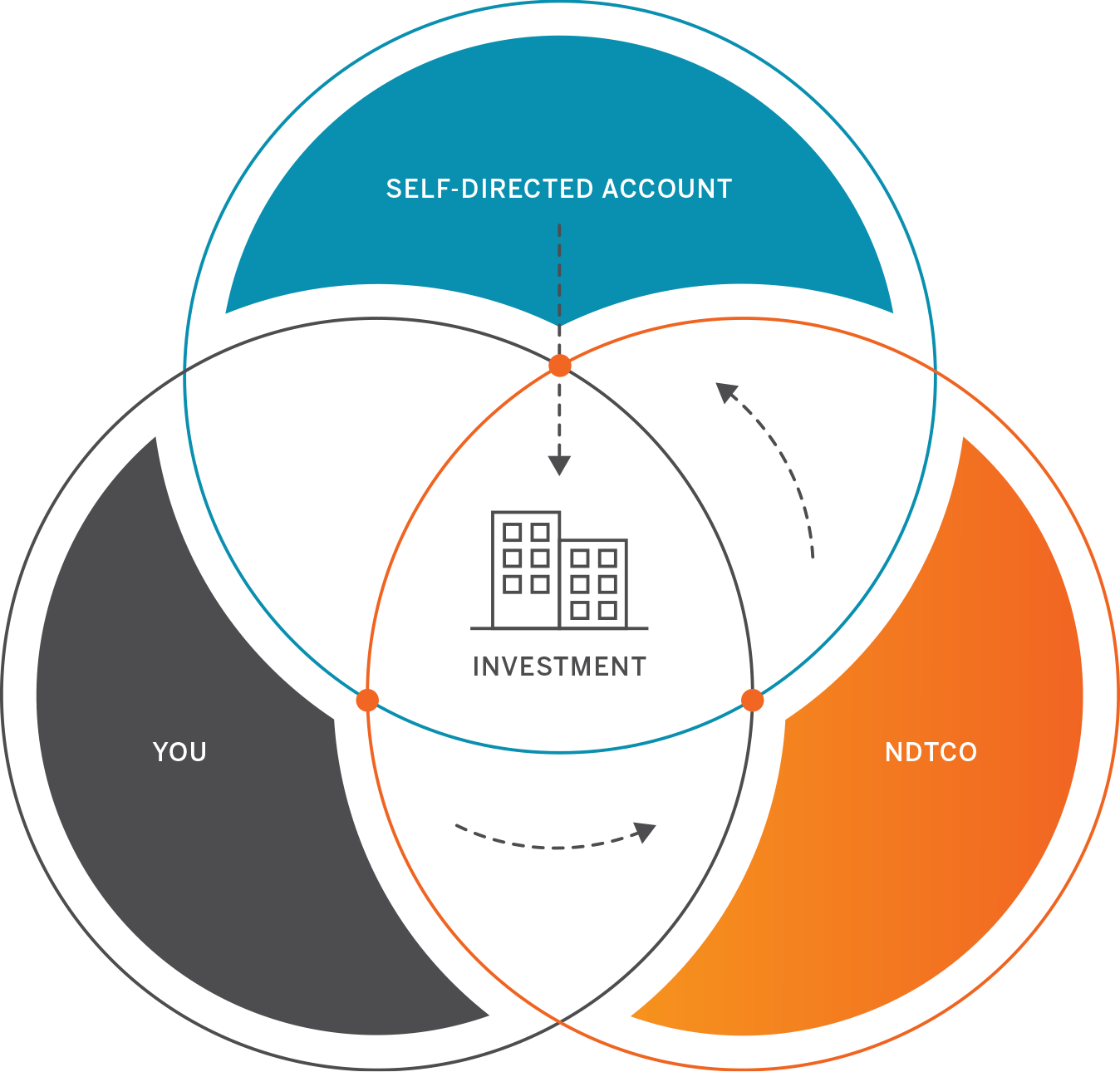

Invest in what inspires you with a self-directed IRA

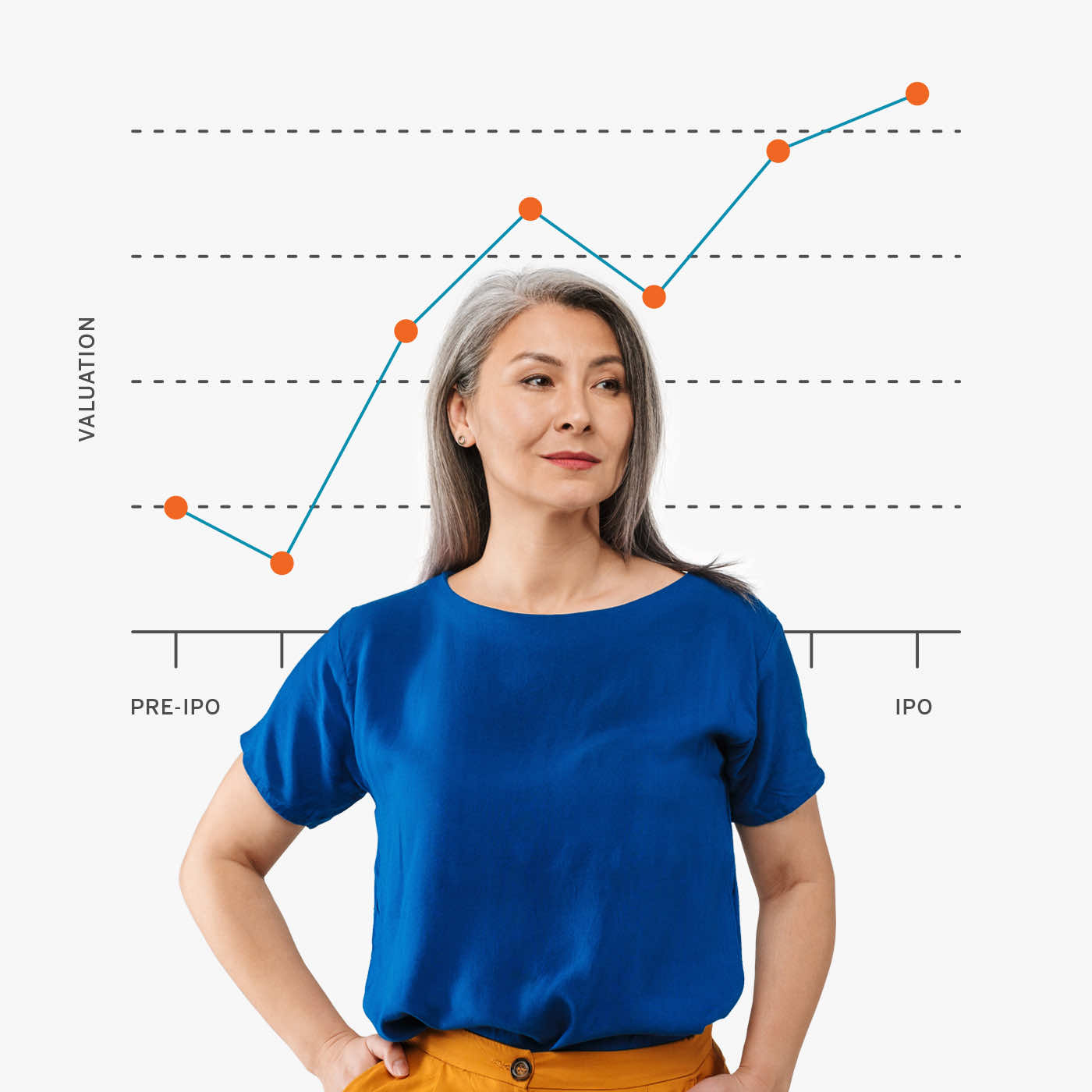

Can you do more for your financial future than cross your fingers and hope the market goes up? Can you venture beyond traditional retirement planning and invest directly in assets of your choosing?

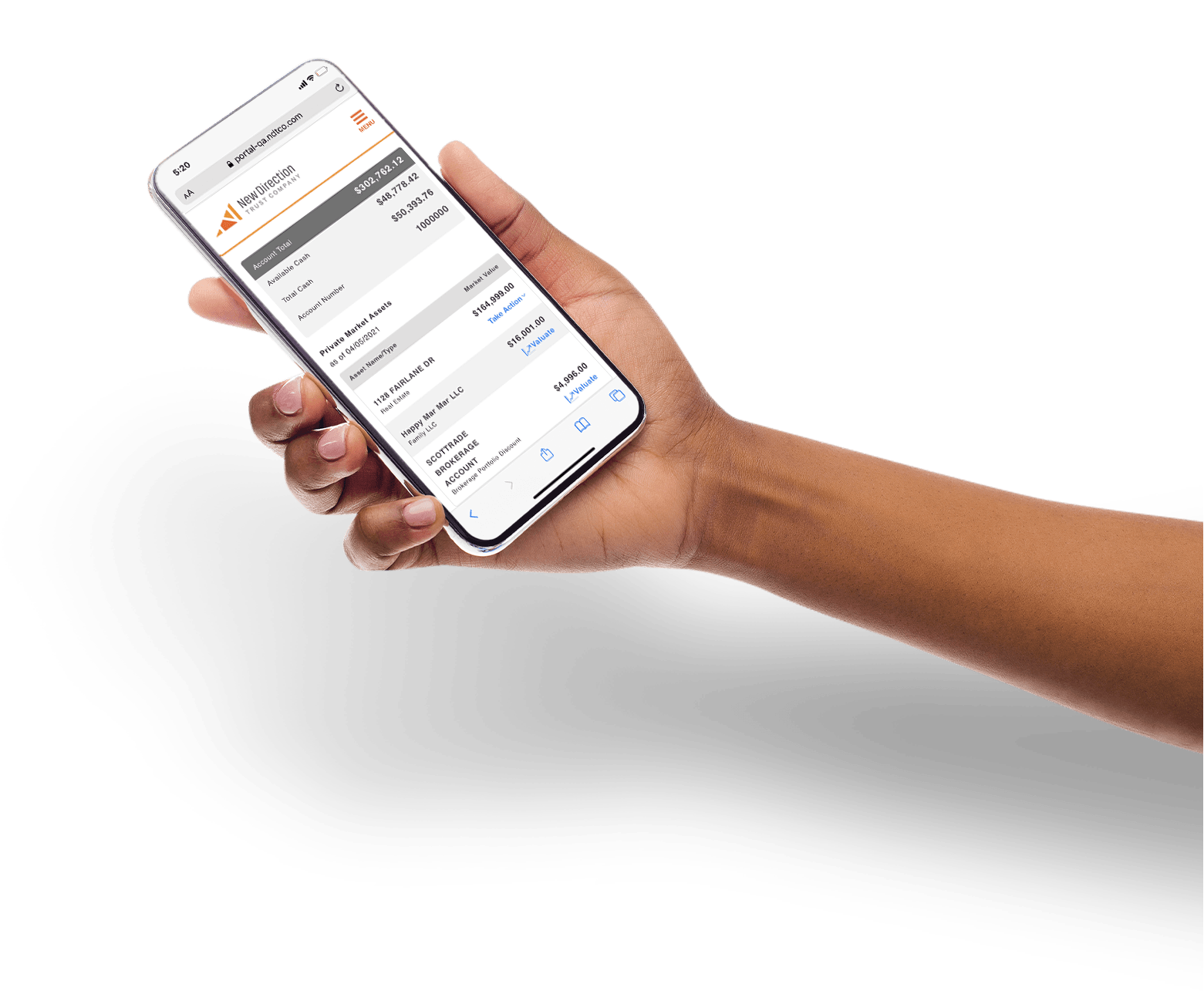

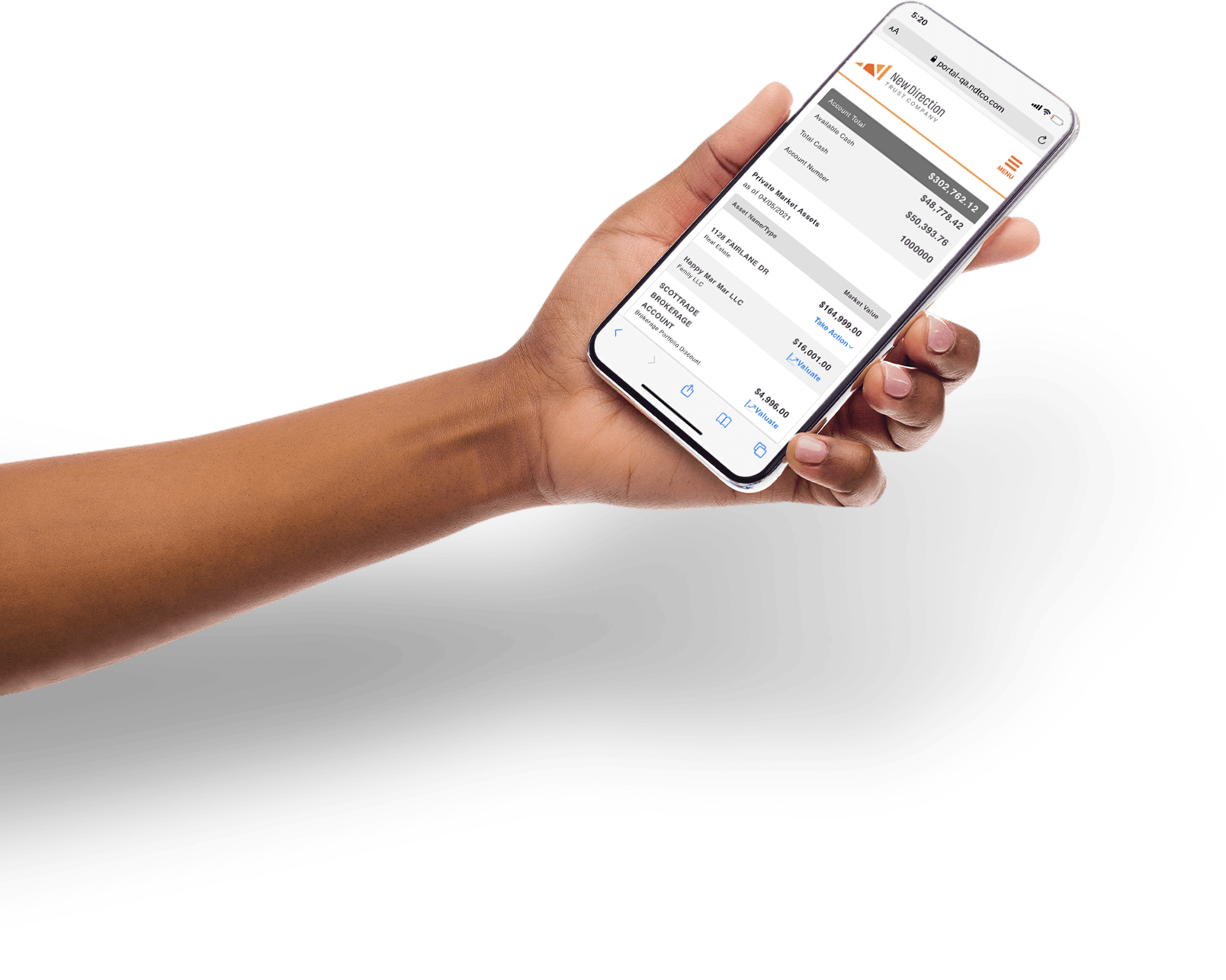

When you have a self-directed IRA partner as experienced, connected, and flexible as New Direction Trust Company, the answer is yes.