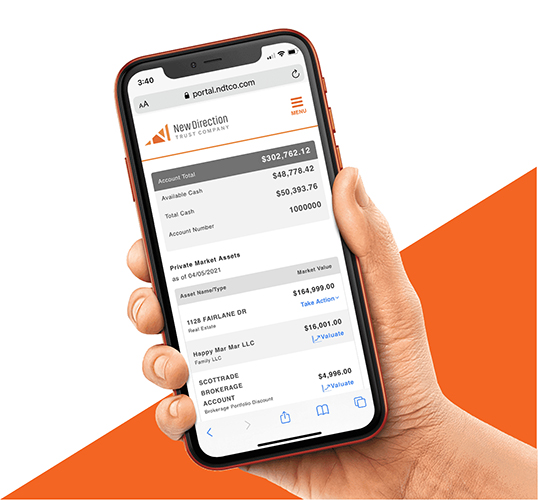

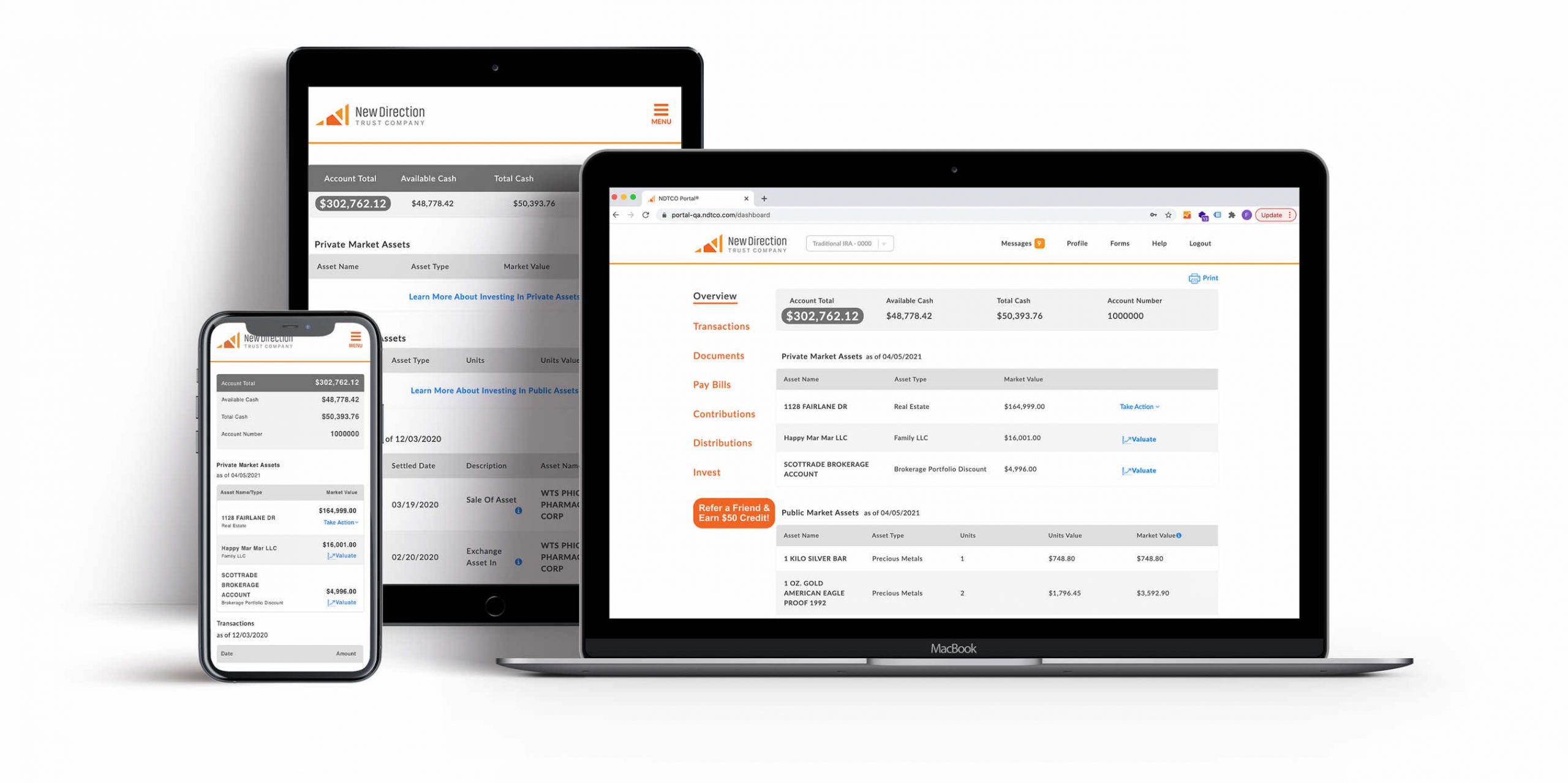

Manage Your Account

Alternative investments made easy

From executing investments to managing returns, you should always feel supported and in control.

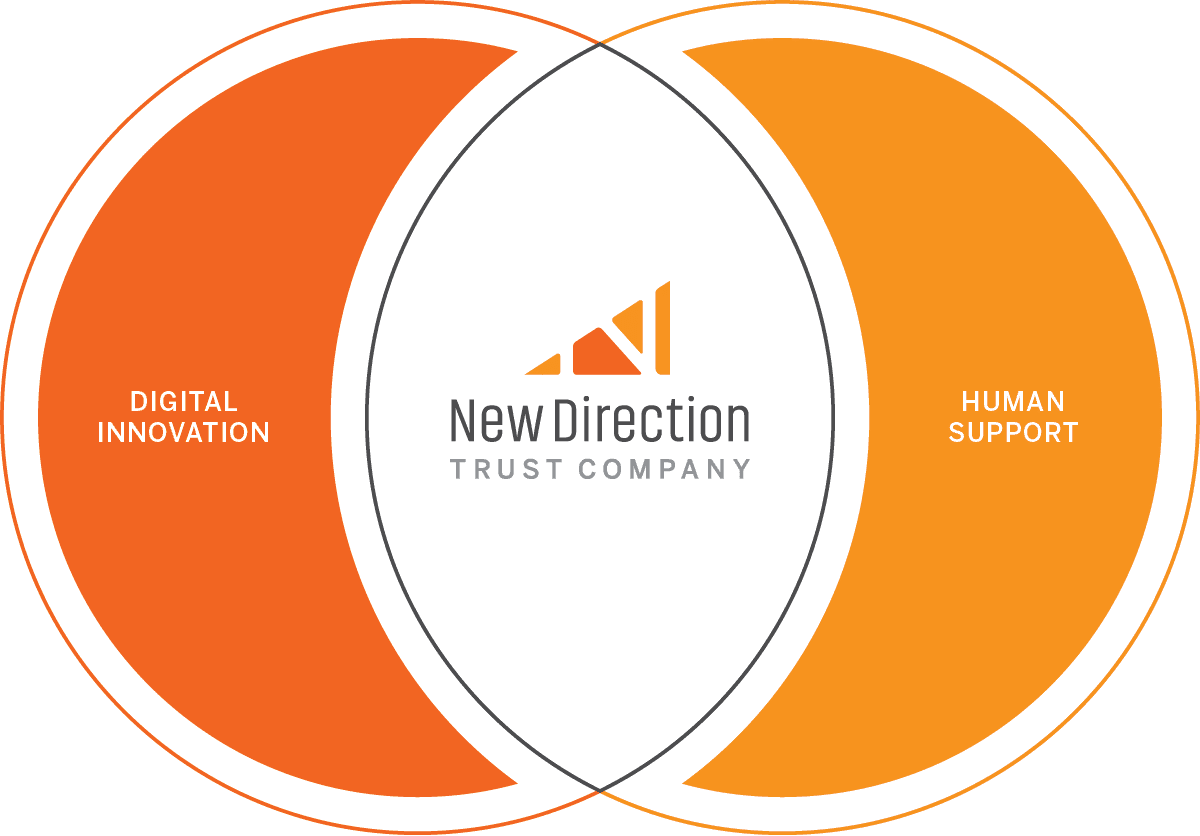

Our world-class digital platform makes it easy to manage your accounts, while a personalized and experienced client service team stands ready to answer questions along the way.

Is it really possible to have the best of both worlds? The answer is yes.