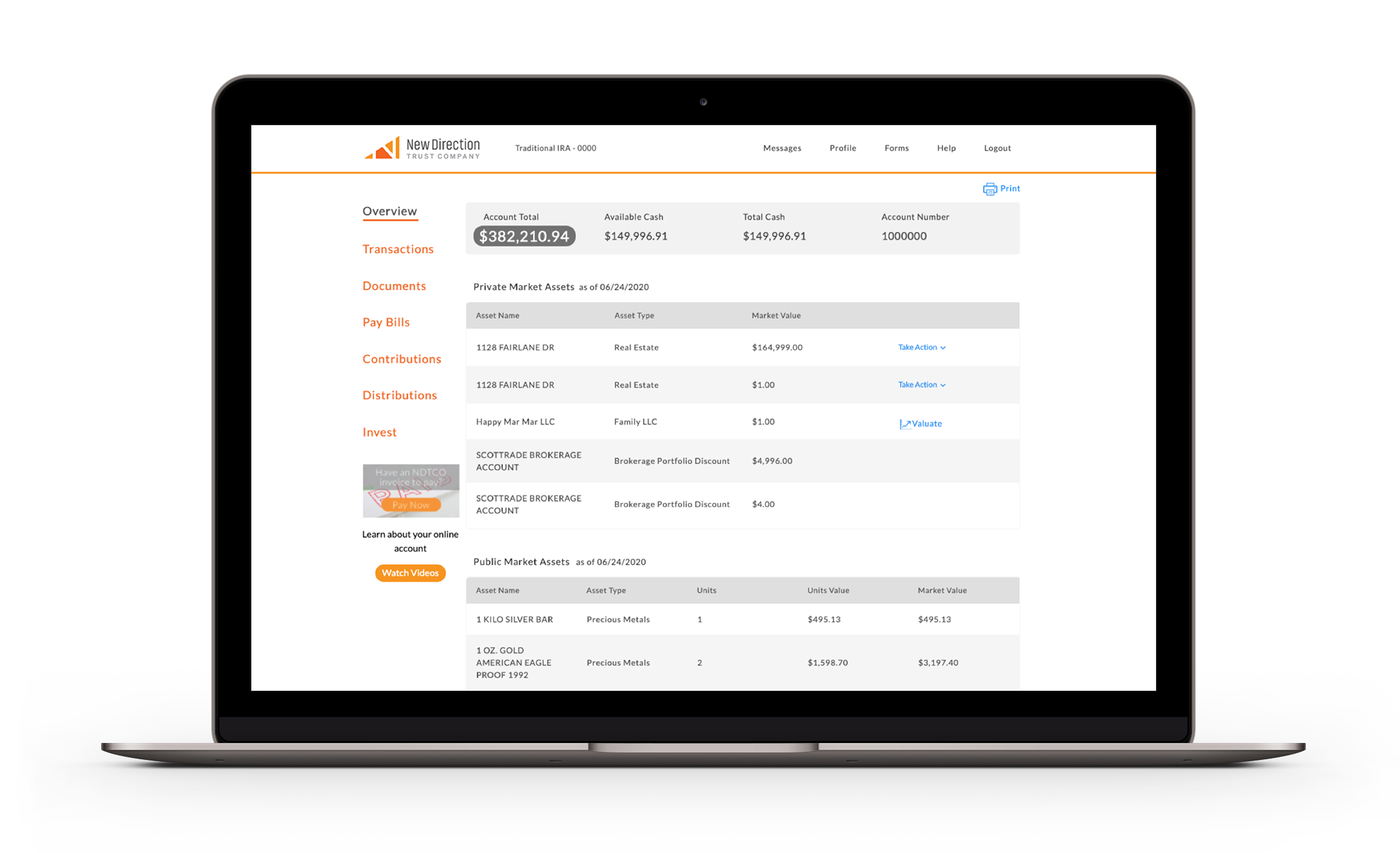

Asset Class

Other Investments

Contrary to popular belief, the IRS allows a broad spectrum of alternative assets in tax-advantaged plans.

If you can invest in it with your personal money, there’s a great chance you can invest in it with your self-directed IRA, Solo 401(k), or Health Savings Account.

- OIL AND MINERAL RIGHTS

- TIMBER

- LIVESTOCK

- AIR AND SPACE

- AND MUCH MORE!