Self Direction 101

Freedom in retirement starts with freedom in investing

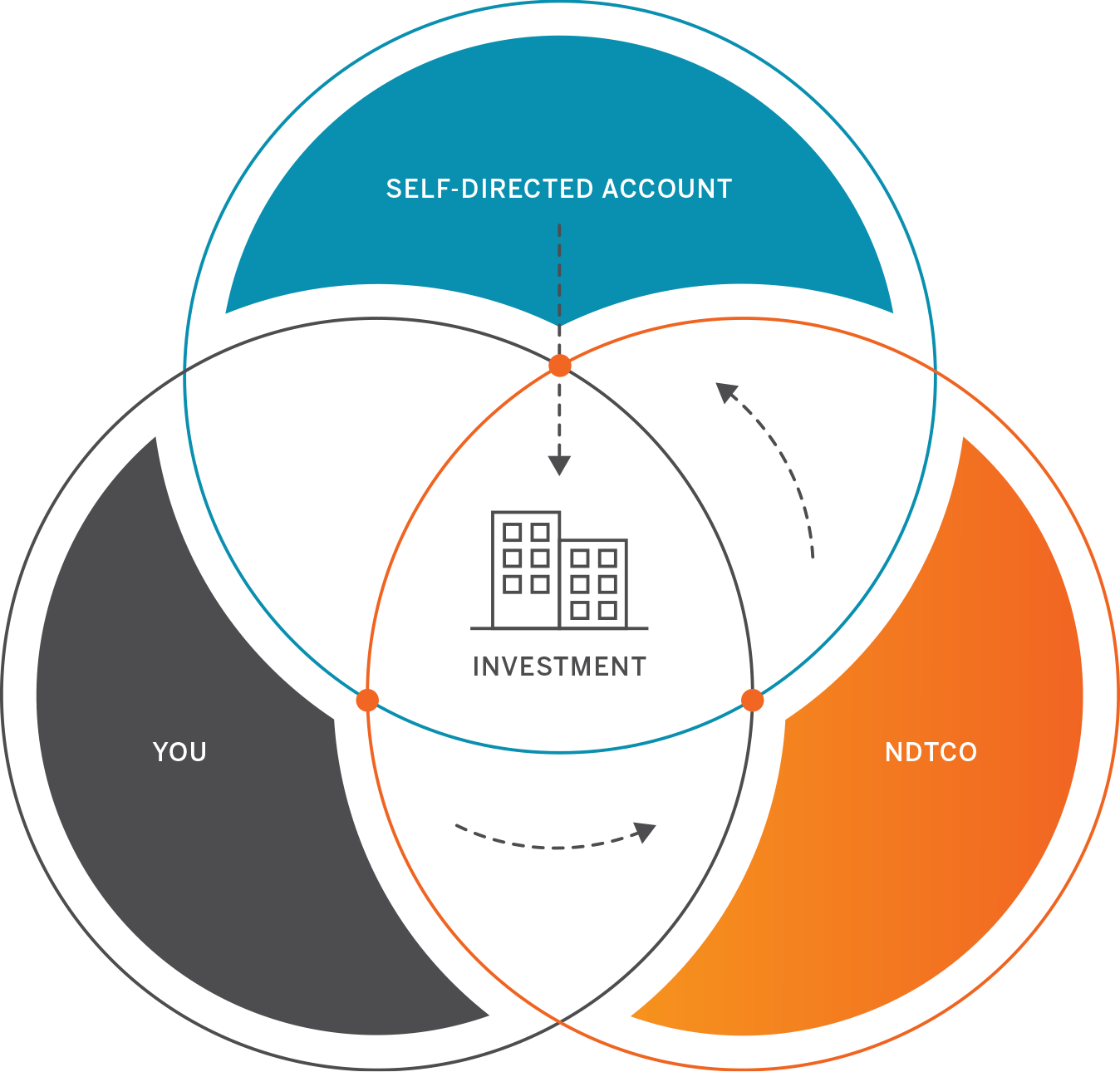

While every IRA has tax advantages, only a self-directed IRA has the advantage of breaking free from the confines of Wall Street to work harder and smarter in the investment of your choosing.

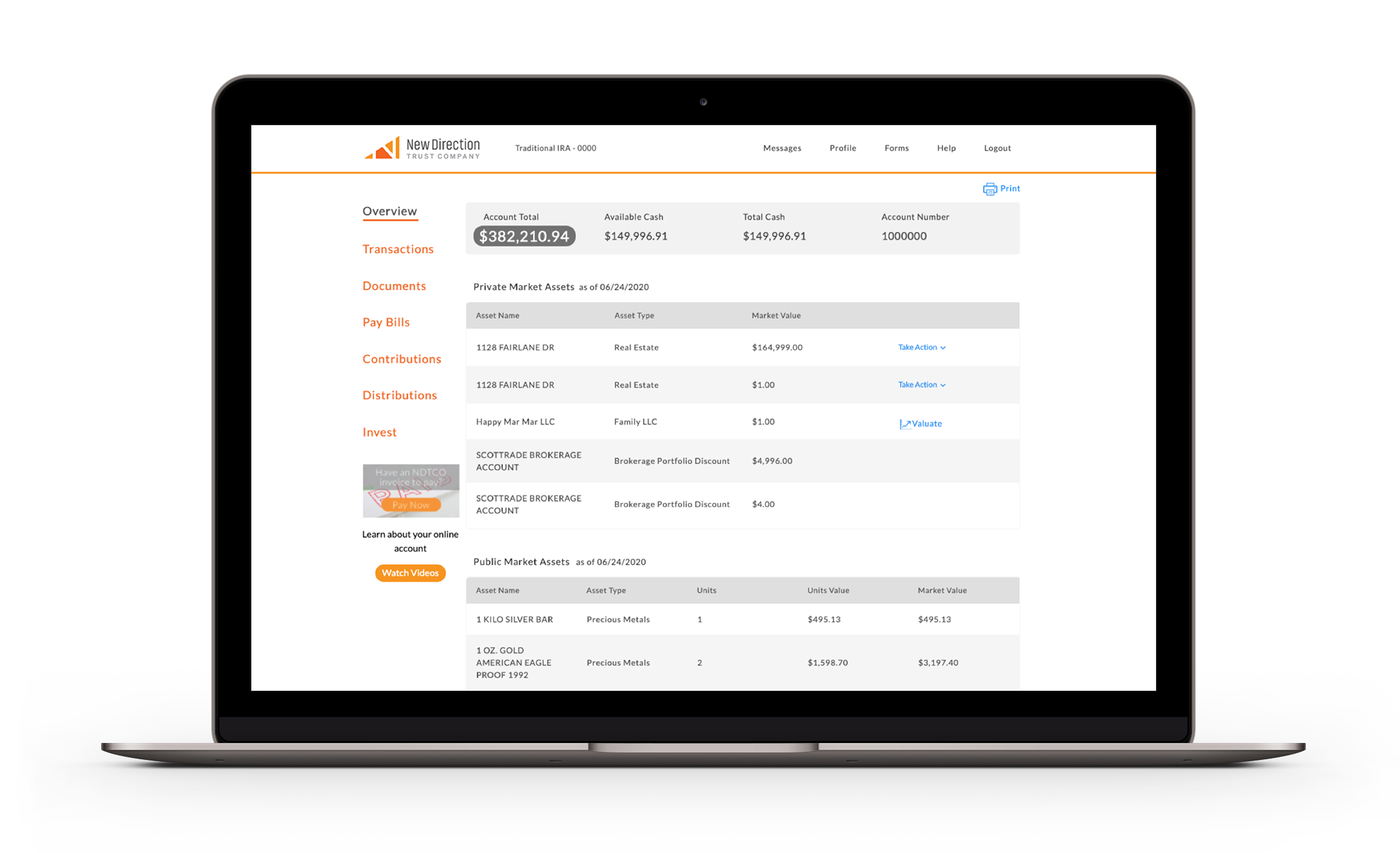

Can your IRA buy a house? Invest in precious metals? Fund a small business? The answer is yes.