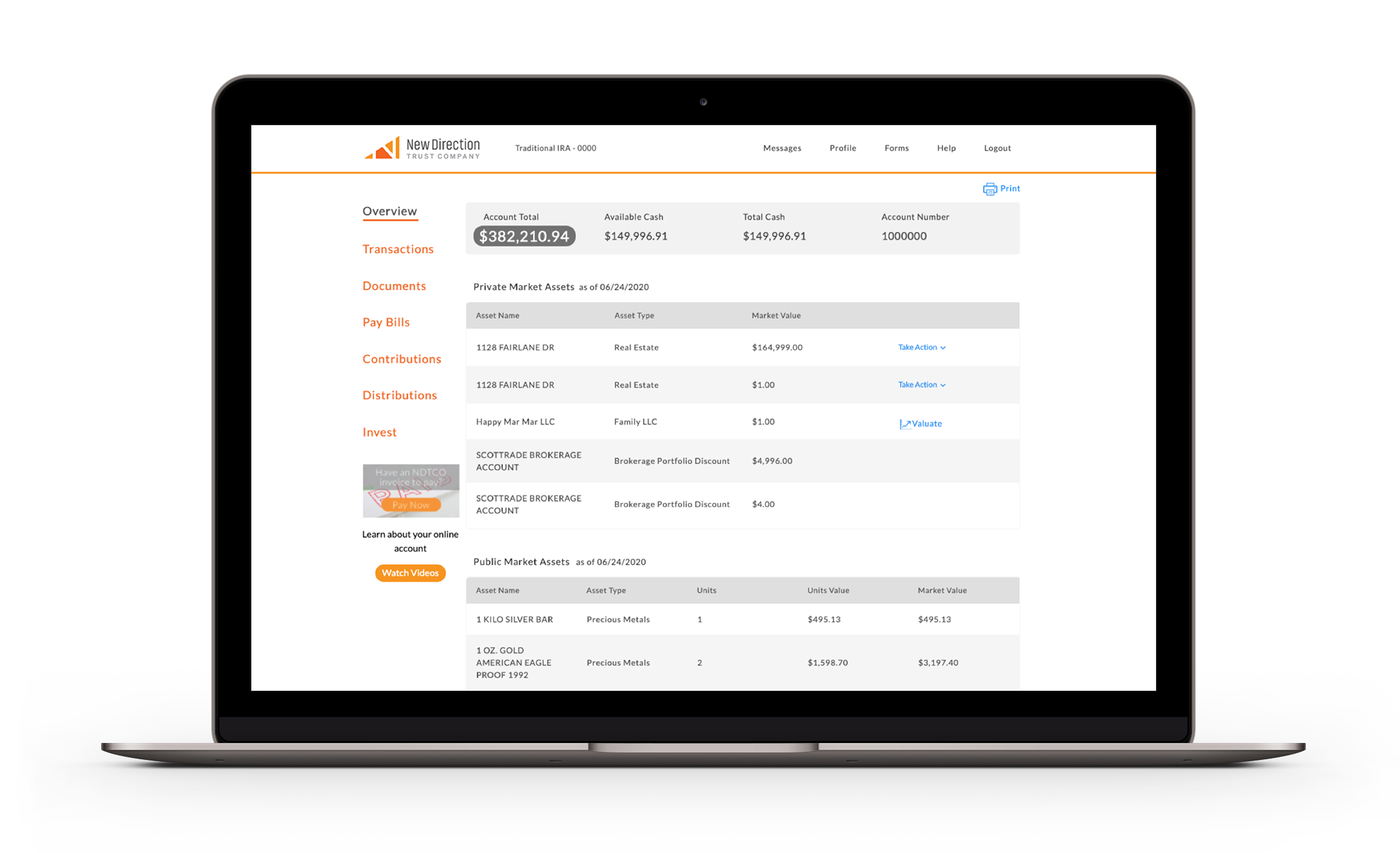

Asset Class

Precious Metals

Your self-directed account can purchase physical gold, silver, platinum, and palladium from the sponsor of your choosing.

Account-eligible precious metals include:

- GOLD (99.5% PURE)

- SILVER (99.9% PURE)

- PLATINUM (99.95% PURE)

- PALLADIUM (99.95% pure)