AN OVERVIEW

What to Know About Self-Directed Accounts

Most people think retirement and tax-advantaged savings can only be invested in stocks and bonds. However, the IRS actually allows you to invest in almost anything—you just have to find a financial custodian who will support you in doing so.

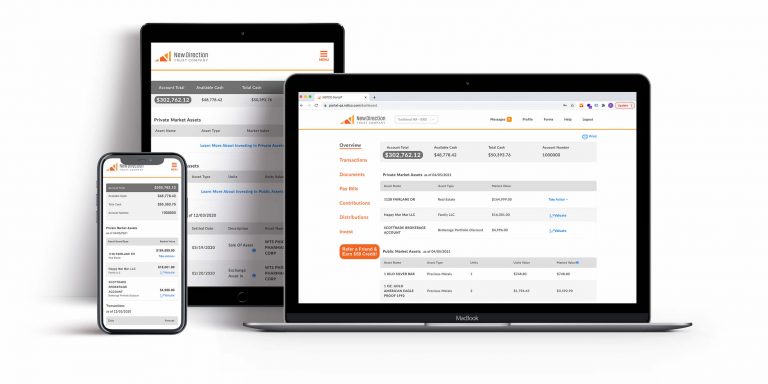

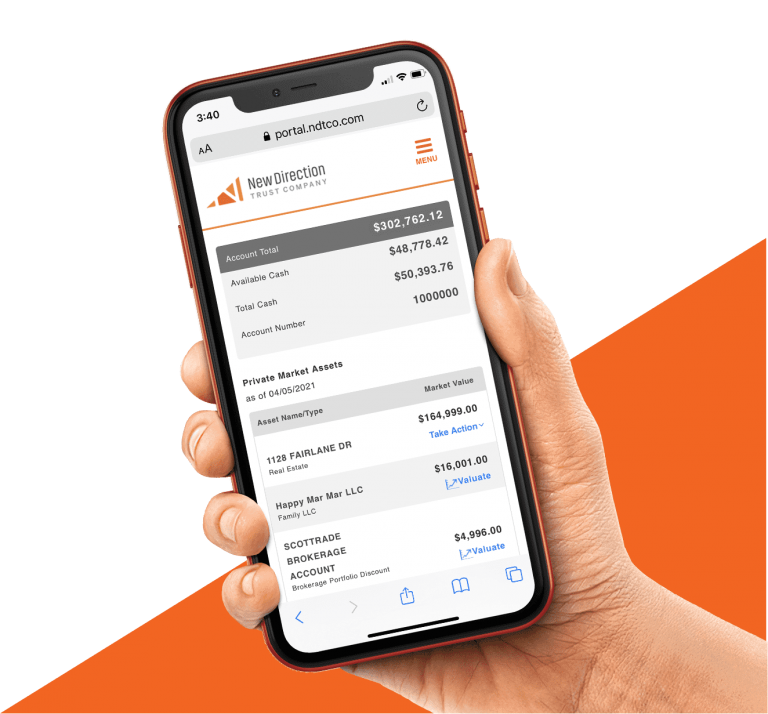

That’s where New Direction Trust Company comes in: we allow our clients to invest in alternative assets like precious metals, real estate, or private equity, using a tax-advantaged account, like a Traditional or Roth IRA.

The specific account type you open with NDTCO carries the same tax benefits and rules that you would find in that account opened anywhere else. A Traditional IRA with us is the same as a Traditional IRA at your local bank—the “self-direction” part simply allows you to invest in an alterative asset like precious metals.

It’s important to note that as an independent self-directed custodian, New Direction Trust Company does not sponsor, endorse or sell any investment and is not affiliated with any investment sponsor, issuer, or dealer. We do not provide investment, legal, or tax advice. Individuals should consult with investment, legal, or tax professionals for such services.