Fund Your Account

Fund your account before you put it to work

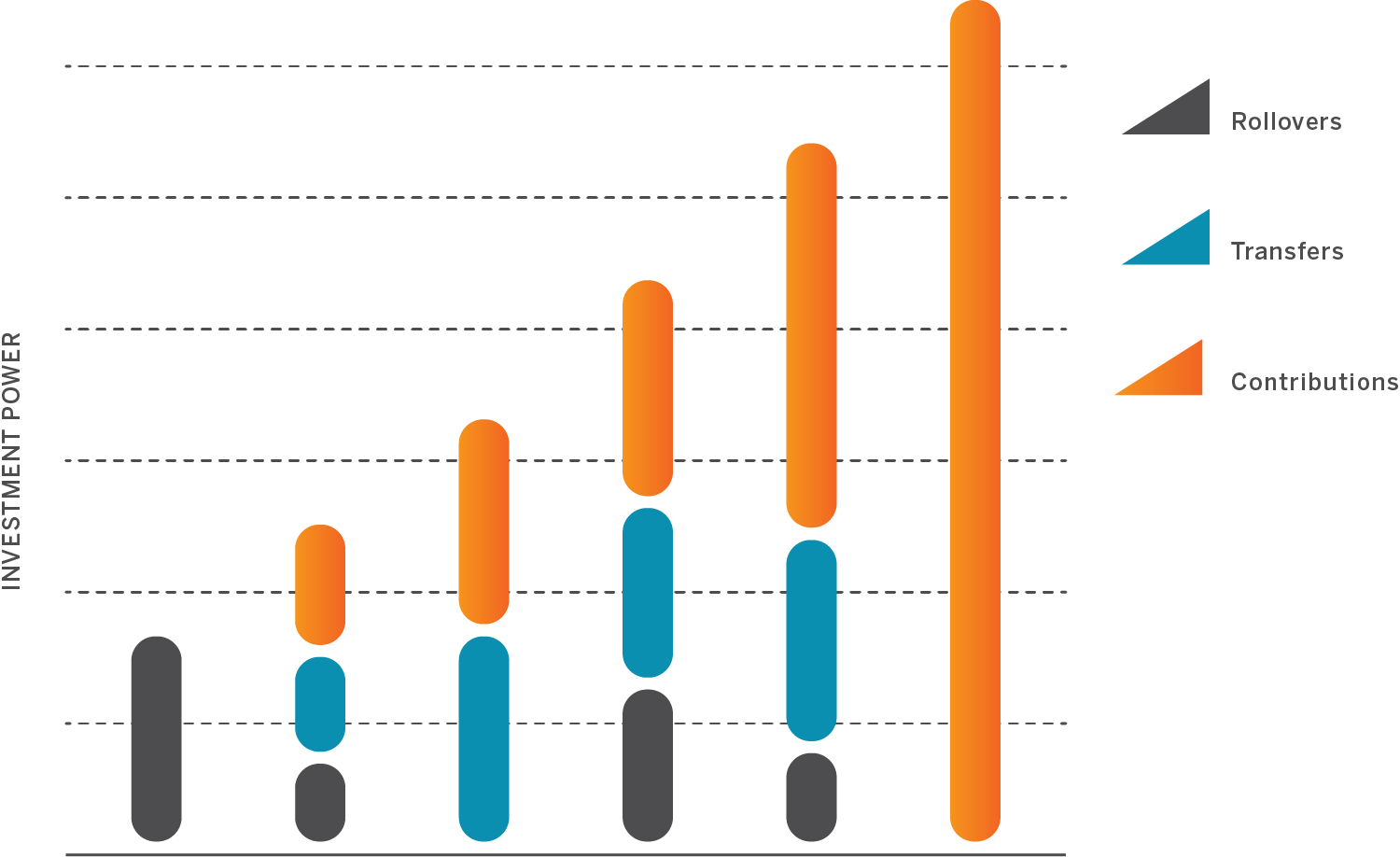

Before your self-directed account gets its investment freedom, you must first fund it by making a new contribution and/or transferring or rolling over an existing account to your financial custodian (that’s us).

Once your funds are secure, you’re free to focus on the big picture while we process your transaction.

Transfers and rollovers are relatively similar transactions in that both involve the movement or consolidation of tax-advantaged money from one retirement account into another, while a contribution is a deposit of non-tax-advantaged funds into a self-directed account.