GEt in touch

Schedule a Call

Want to learn more about self-direction and how you could take a controlling interest in your future?

Schedule a call with a member of our team today! They will help answer any questions you have and provide you with the tools and knowledge to feel confident in your self-directed investments.

Fill out your information below to schedule time with a member of our team

Self-Directed Investments

Can you invest in THAT? The answer is yes.

With a self-directed account, you have the freedom to invest your tax-advantaged retirement funds in the assets you’re most passionate about. From real estate to start-ups to precious metals, if you can find it, we will help you fund it.

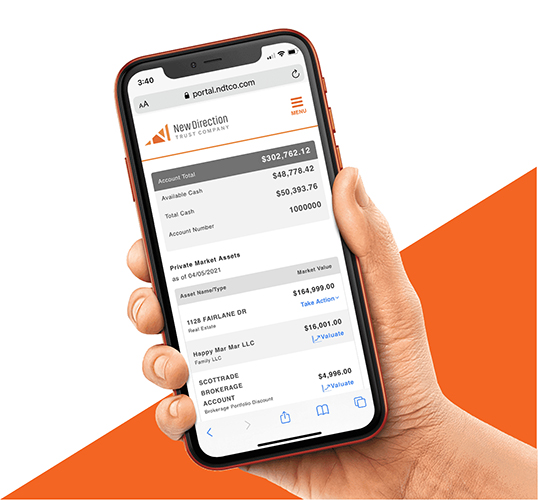

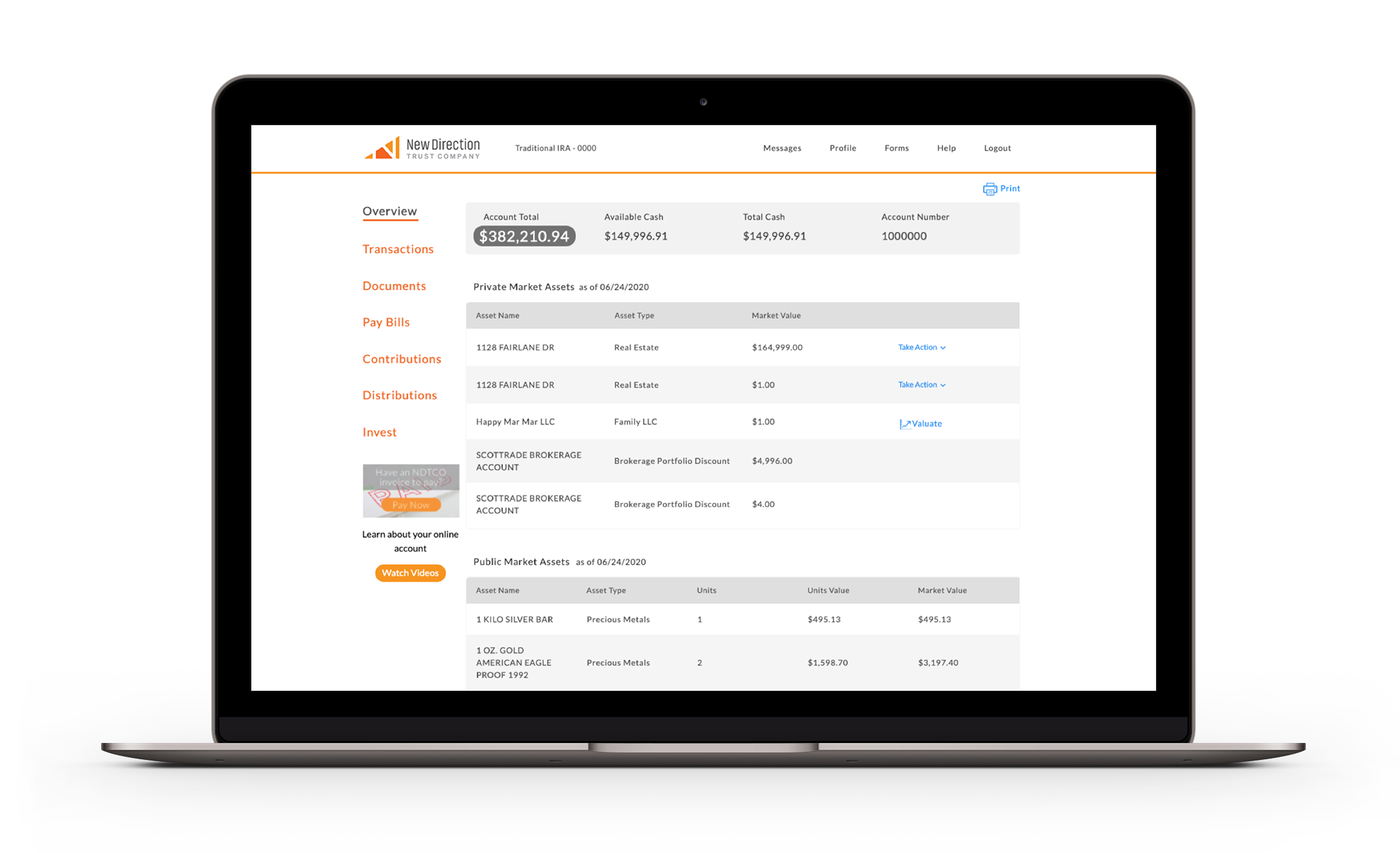

Account Management

It’s not a platform so much as a launchpad

Self-directed opportunities are only a click away. Manage your portfolio, paperwork, contributions and distributions, or simply watch your investments grow from the NDTCO client portal.

Education Center

Want to learn more about self-directed investments?

Upcoming IRA Events

- Thu23 Jan12:00PMMST

Alternative Investing 101

ONLINECan you venture beyond traditional retirement planning and invest directly in assets you are passionate about. With NDTCO, the answer is YES! Discover the many advantages of having a self-directed IRA and why investing in alternative assets like real estate, precious metals, and private equity can help protect and grow your hard-earned savings.REGISTER