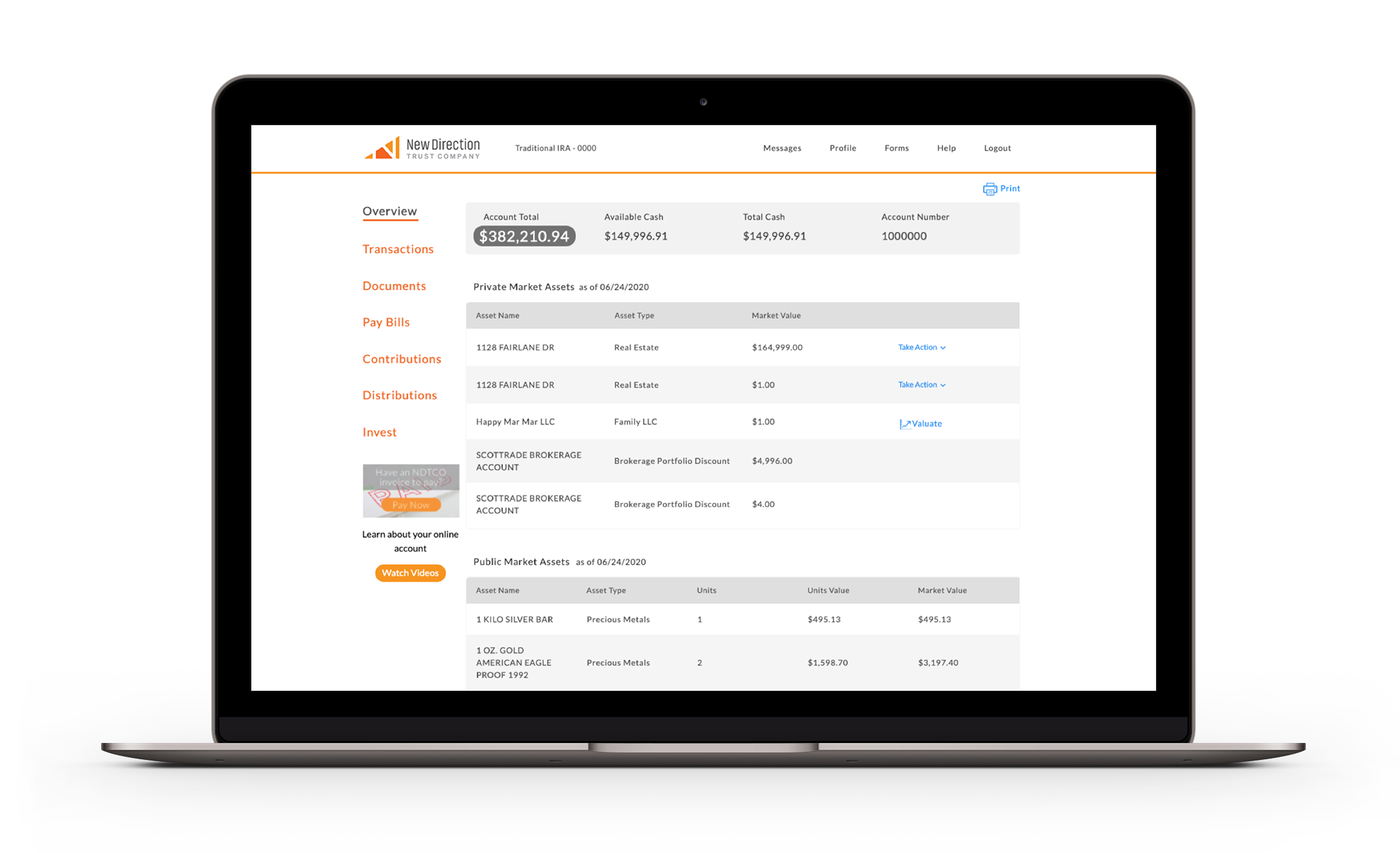

Asset Class

Checkbook IRA/LLC

Establish an LLC/entity, fund it with your retirement dollars, and fulfill investments yourself. As the account holder, you have “checkbook control” over the LLC funds, and thus checkbook control of your tax-advantaged funds.

- LIMITED LIABILITY COMPANY (LLC)

- LIMITED PARTNERSHIP (LP)

- C-CORP