Before German countess Karlotta Liebenstein died in 1922, she made sure that her fortune would end up where she wanted it to go—to her german shepherd, Gunther I. Now, six generations later, his progeny Gunther VI is still enjoying his ancestor’s fortune.

If you don’t name a retirement beneficiary—or worse, you have an outdated beneficiary form that names the wrong people—your loved ones will get a lot less than Gunther the VI did. They’ll have to go through probate court, which could take months, or get nothing at all.

Luckily, choosing a beneficiary and keeping your beneficiary forms updated is easy, especially using the NDTCO client portal.

What is a beneficiary? And other important questions

All of your retirement accounts—your Traditional IRAs, SEP, SIMPLE, Roth, your 401(k)s from present and past employers, 403(b)s, and deferred-compensation employer plans—have beneficiary forms. Whoever you name as your beneficiary will receive the assets or funds in your accounts, allowing you to provide care of them even after you’re gone.

What is the difference between primary and contingent beneficiaries?

There are two kinds of beneficiaries: the primary beneficiary and the contingent beneficiary. Your primary beneficiary (or beneficiaries, as you can have more than one) is the first in line to inherit your assets. Your contingent beneficiary will be next in line to inherit your assets if your primary beneficiary is deceased or can’t be found.

How many beneficiaries can I have?

There is no limit to the number of beneficiaries, primary or contingent, you can have on one account. You can differentiate the allocation percentage for each beneficiary as well. For example, you may want your spouse to receive 50% of your assets and the remaining 50% to be split amongst your siblings.

What happens if no beneficiary is named on a 401k, IRA, or other retirement accounts?

If no beneficiary is named, your assets go to your estate, and the government decides on distribution—which means neither you nor your family has control over government decisions. If you’ve invested in real estate, for instance, and didn’t name a beneficiary, it could take months for the probate court to decide the value of those assets and where they will end up.

Who can I not name as a retirement beneficiary?

You cannot name your estate as your beneficiary. However, if you’ve not named a beneficiary, all your assets will go to your estate, giving the government complete control over the contents of your retirement accounts.

Choosing your retirement beneficiaries

Most individuals name spouses and children as beneficiaries—but that’s not always the case. Be intentional about naming your beneficiaries so that you can continue taking care of your loved ones even after you’re gone.

Consider who you want to provide for.

Remember that you can name more than one person as your beneficiary and you can differ the allocation to all those named. If any of your beneficiaries are high earners, you should be aware that you could run the risk of bumping them into a higher tax bracket by leaving them with an inherited IRA. If you name a minor, you should also designate a custodian or financial planner to assist them in receiving and handling the asset.

Ensure your beneficiary designation form is correct.

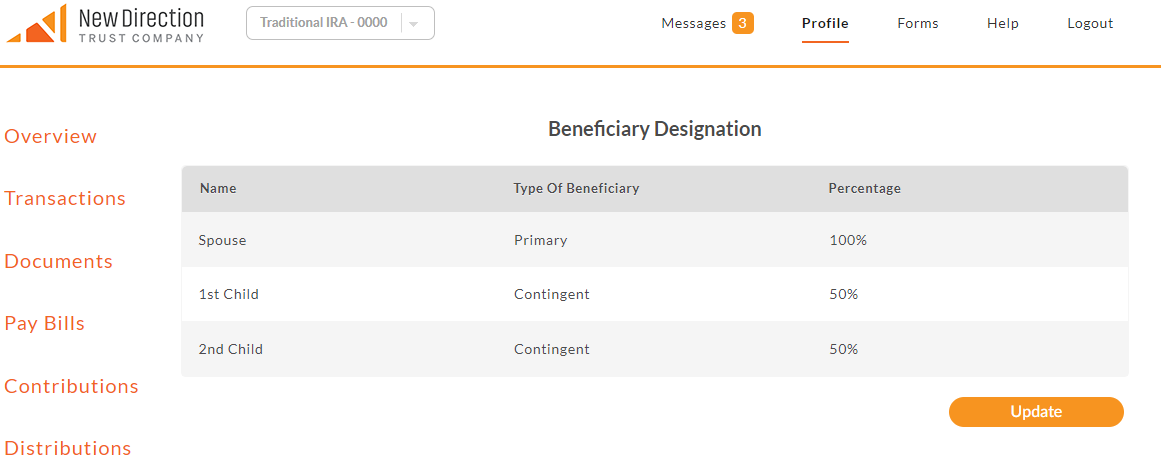

When you’ve decided who you want to name as a beneficiary, sign in to the NDTCO client portal and navigate to your Profile. You can also click on this link to go straight to your Beneficiary Designation. From here, you’ll see your current beneficiary designations, along with the percentage you want them to receive. If you need to add or change your Beneficiaries, you can do so by clicking the Update button on the bottom right.

Do an annual review of your beneficiaries.

Every year—and after major life changes—go into your NDTCO account to review and update your beneficiaries. Keeping your beneficiary form updated is a gift that you can give to your loved ones to ensure they are easily able to receive what you intend for them.

Questions about beneficiaries? NDTCO can help!

Please give us a call at 877-742-1270, or send us a message through the Client Portal if you have questions we can assist you with.

Back to Blog

Back to Blog