ANNOUNCEMENT

Welcome Clients from The Royal Mint!

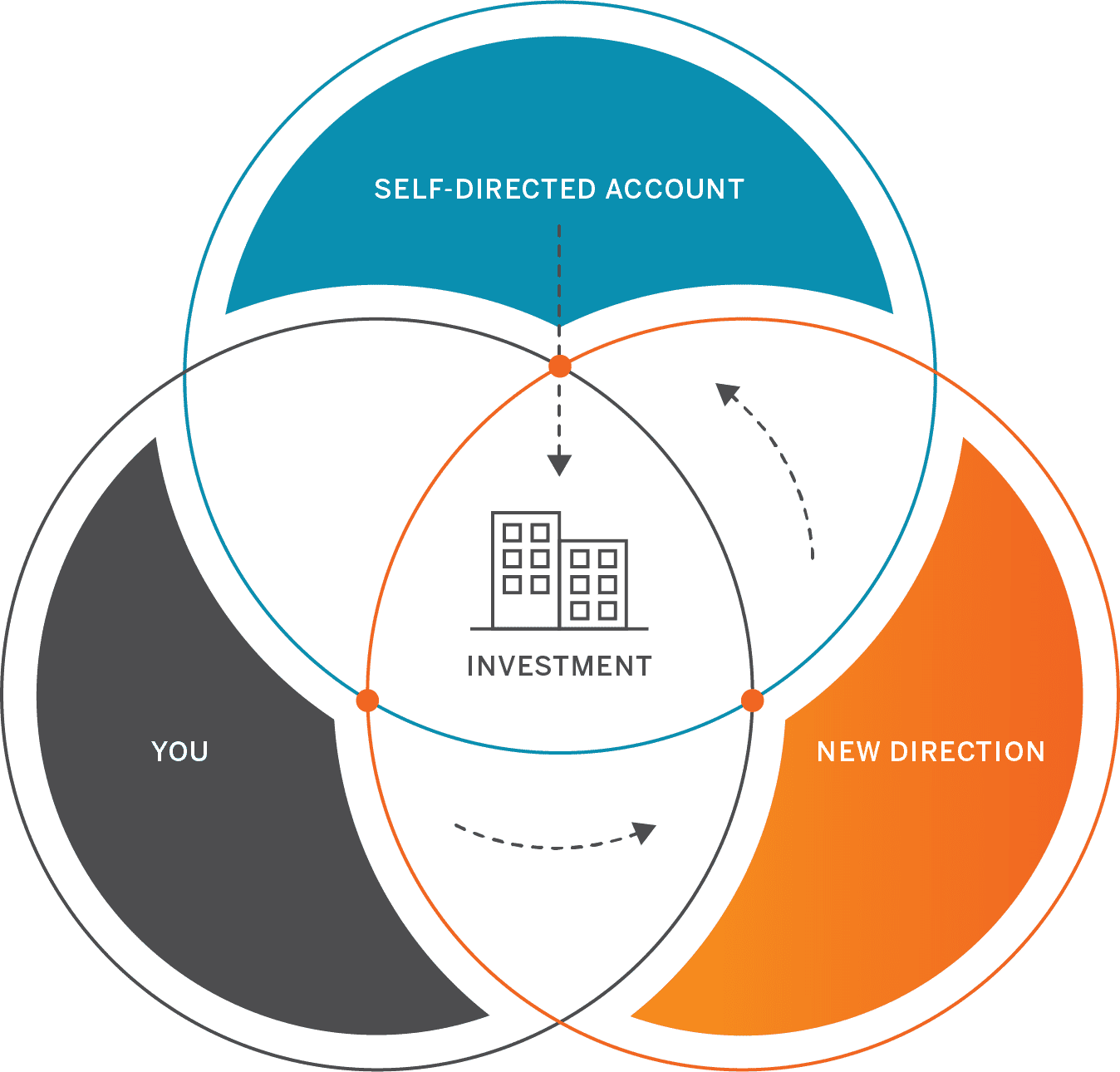

New Direction Trust Company is excited to be the first self-directed company to officially collaborate with The Royal Mint!

Whether you are interested in investing in gold, silver, or physically-backed digital precious metals, it is now easier than ever to diversify your portfolio with a tax-advantaged self-directed account with NDTCO.

When you are ready to get started with your self-directed account, use the promo code ROYALMINT to waive all account opening fees, just for being a client of The Royal Mint!